An escrow service is a third-party intermediary that ensures both parties of a transaction will get what they’re expecting. Escrow services can be used just about anywhere and for any type of transaction. Think of it as the ultimate promise that your money in your transactions is safe. Escrow services in Mexico, however, are relatively new. In recent years, brokers and agents have seen the benefits of using escrow. The use of escrow motivates both the buyer and seller to move efficiently through the closing process.

Why Should I Choose an Escrow Services Company to Complete My Transaction?

If you are conducting any type of business transaction in Mexico, it is highly advisable to use an escrow services company to complete the transaction. Here are some reasons why:

- Escrow companies are neutral third parties that hold onto the funds involved in a transaction until all conditions of the deal have been met. This protects both buyers and sellers from any potential fraud or scams.

- Escrow companies can help facilitate transactions by providing various services such as language translation, legal assistance, and currency exchange.

- Using an escrow company can help speed up the transaction process and ensure that all parties are satisfied with the outcome.

- Escrow companies provide an extra level of security and peace of mind for both buyers and sellers.

What are the Different Types of Escrow Services?

There are a few different types of escrow services available in Mexico. The most common is the fideicomiso, which is a government-backed trust that allows foreigners to purchase property in restricted areas. Although, the process of opening a fideicomiso is usually lengthy, bureaucratic and expensive. There are also private escrow companies that can provide services for buyers and sellers who are not using a fideicomiso.

The type of escrow service you use will depend on the type of property you are buying and your personal preferences. If you are buying property in a restricted area, you will need to use a fideicomiso. If you are not using a fideicomiso, you may be able to choose between a private escrow company such as WaloPay or working with the title company directly.

Whichever type of escrow service you choose, it is important to make sure that you understand the process and what is required of you before entering into any agreements.

How Do I Choose the Right Escrow Service in Mexico?

There are a few things to consider when choosing an escrow service for your Mexican real estate transaction. First, you’ll want to make sure the company is reputable and has experience handling transactions in Mexico. You’ll also want to ask about their fees and what type of triggers they have for releasing funds.

It’s also important to understand how the escrow process works in Mexico. The general timeline with WaloPay is as follows:

- The buyer and seller agree on a purchase price and sign a purchase agreement.

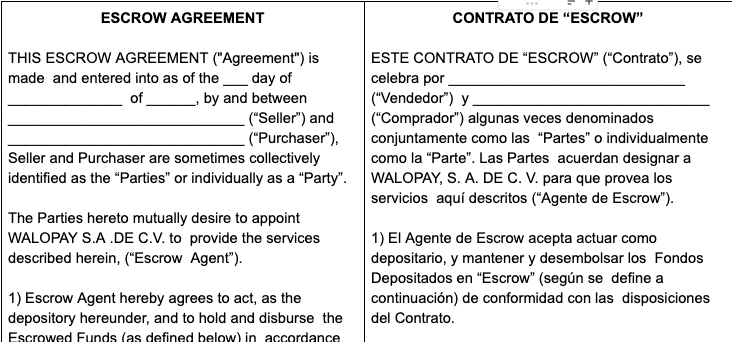

- They both create a transaction on WaloPay with the escrow detailes and sign the escrow agreement.

- The buyer deposits the agreed upon amount into WaloPay.

- The seller provides proof of ownership of the property and other required documents to the buyer.

- Once all conditions of the sale are met, both parties can close the transaction on WaloPay and the funds are released to the seller and the buyer takes possession of the property.